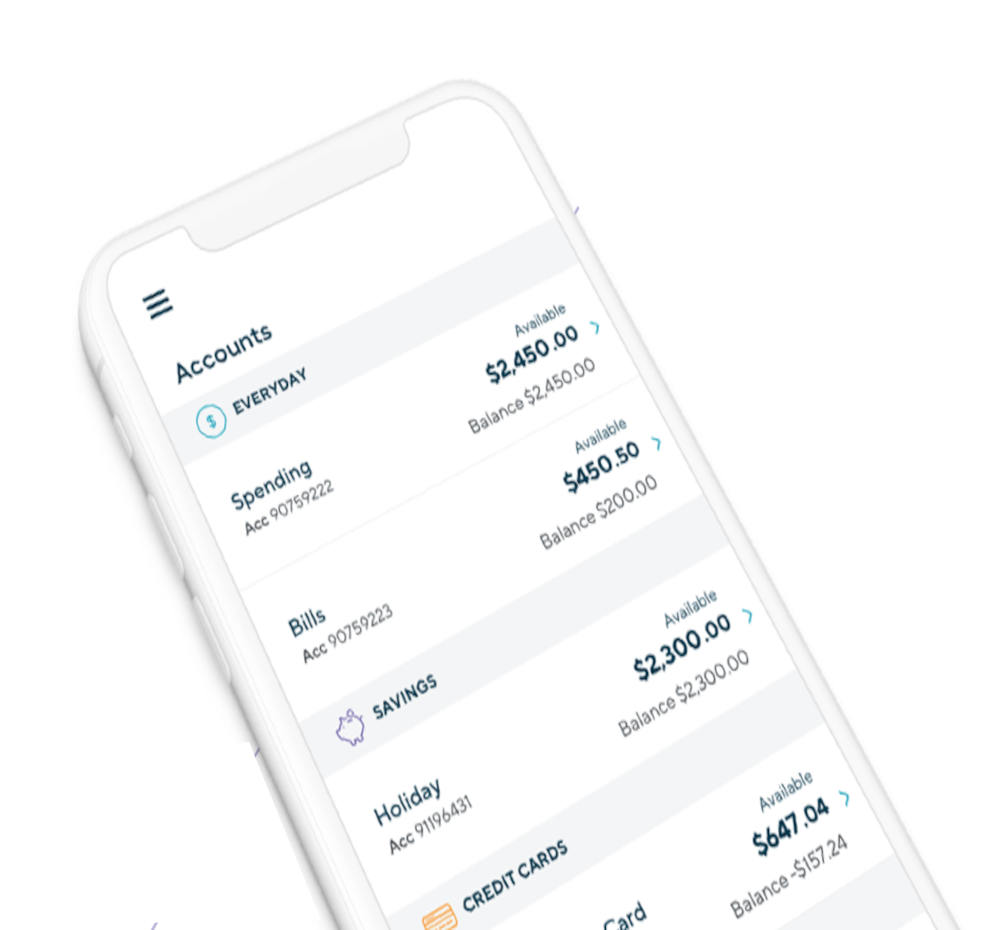

Streamline your financial wellbeing

Tailored accounting and taxation solutions

Coastside Accounting

Scott Maiden T/as Coastside Accounting is a tax agent who is committed to adhering to the highest of professional standards.

I am committed to:

- Honesty and integrity

- Independence

- Confidentiality

- Competence

- Reasonable care in service delivery

As a Tax Agent, our work for you is performed under the Tax Agents Services Act 2009. Under the Act, the Tax Agent Services (Code of Professional Conduct) Determination 2024 requires that I make the following disclosures to you. The Tax Practitioners Board (the Board) are the regulator of Registered Agents. I am also required to adhere to the requirements of the ATO in our interactions with their Online Services and use of other relevant software.

Matters that I believe could significantly influence your decision to engage me (or continue to engage me) for a Tax Agent Service from 1 July 2022 onward include the following:

I advise that, to the best of my knowledge and based on all information known to me, I

- Have not committed a prior material breach of the Act or instruments under the Act

- The Tax Practitioners Board is not investigating me on any matter of a material breach

- Are not subject to any sanctions imposed by the Tax Practitioners Board

- Do not have any conditions imposed on my registration

- Have not been disqualified from providing Tax Agent Services

- Do not have employees, nor engage with others who have been disqualified from providing services

- Have in place the appropriate and required processes and systems for supervision and quality control of all work performed on our behalf

- Have not had any charge or conviction relating to an offence of fraud or dishonesty

- Have not had any imposition of a promoter penalty under the tax law

- Have not had any charge or conviction relating to a tax offence and

- Currently do not, nor intend to, outsource work to overseas providers.

I am not aware of any matter that I have not previously discussed or presented to you that would significantly influence your decision to engage or continue engaging my services. Should you have any concerns or matters that you feel need to be addressed, please feel free to Contact Us.

The TPB’s register confirms that I am a registered Tax Agent, with no conditions imposed on my registration.

Quality Management Systems (QMS)

To support our clients and uphold regulatory standards, I have implemented internal procedures to ensure:

- Accurate and timely delivery of services

- Clear communication and record-keeping

- Prompt response to client feedback or concerns

- Ongoing review and improvement of our work practices

- Continued professional education to stay current with changes in taxation legislation

- These practices form the basis of our QMS, aligned with the TPB’s expectations.

Quality Management Systems (QMS)

To support our clients and uphold regulatory standards, I have implemented internal procedures to ensure:

- Accurate and timely delivery of services

- Clear communication and record-keeping

- Prompt response to client feedback or concerns

- Ongoing review and improvement of our work practices

- Continued professional education to stay current with changes in taxation legislation

- These practices form the basis of our QMS, aligned with the TPB’s expectations.

We have small business packages (bronze/silver/gold) for GST registered clients.

We’ve Got You Covered

Accounting & Bookkeeping

Cashflow Planning

Tax Returns

SMSF Management

Business Advisory

Compliance

places you at an equal level.

Why choose Coastside Accounting?

We are passionate about helping people build a successful and comfortable lifestyle through financial success. For more information on how our services can help you or your business, get in touch today.